Futures Spread Roll

A favoured approach for tracking Spread rolls is to not split the contract, retain the fixing family, include the roll in the contract price and retain the traded premium. It's helpful if the spread roll can be identified and to move the pricing month to the roll month en masse. This is achieved as follows:

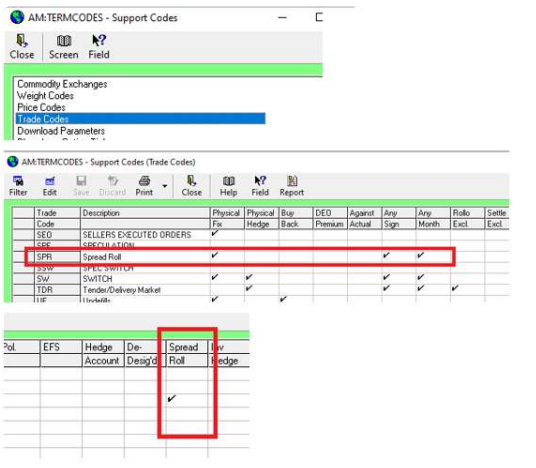

- Identify the roll trades by their TERMCODES/Trade i.e. flagged as 'Spread Roll'

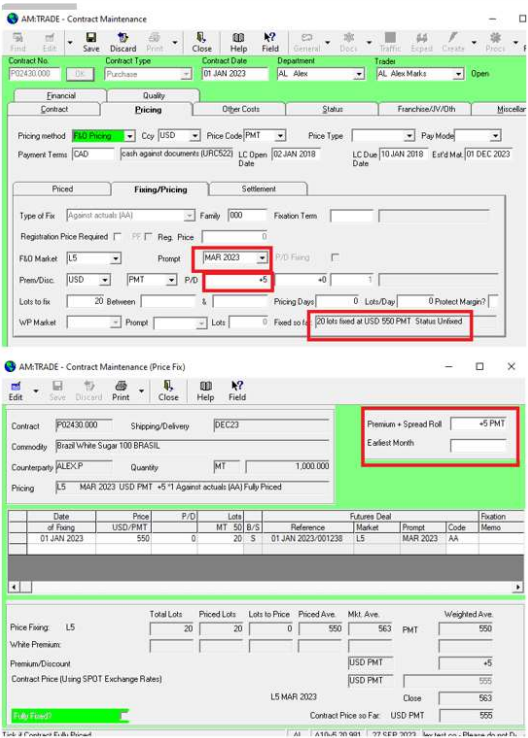

- Save spread and earliest month when the pricing is executed

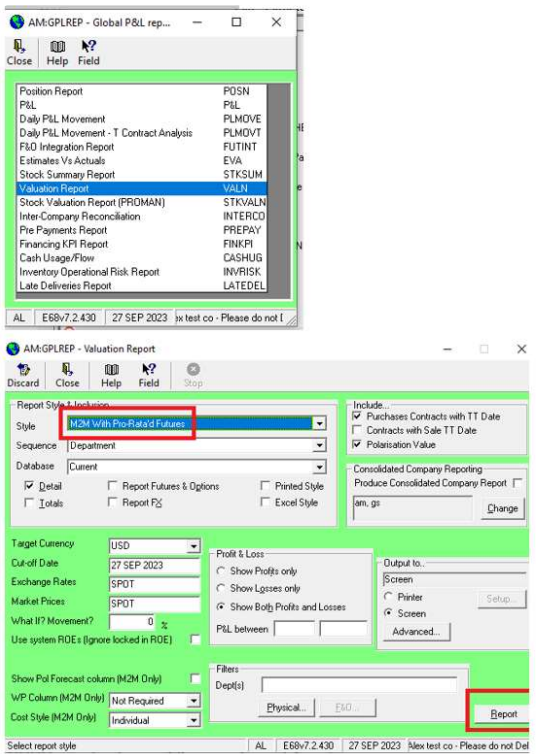

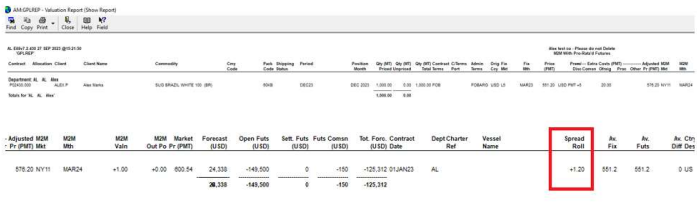

- The spread is shown on the Price fixing tab in Trade, on the Trade/Price fixing form and as a column in GPLREP/Valuation Report

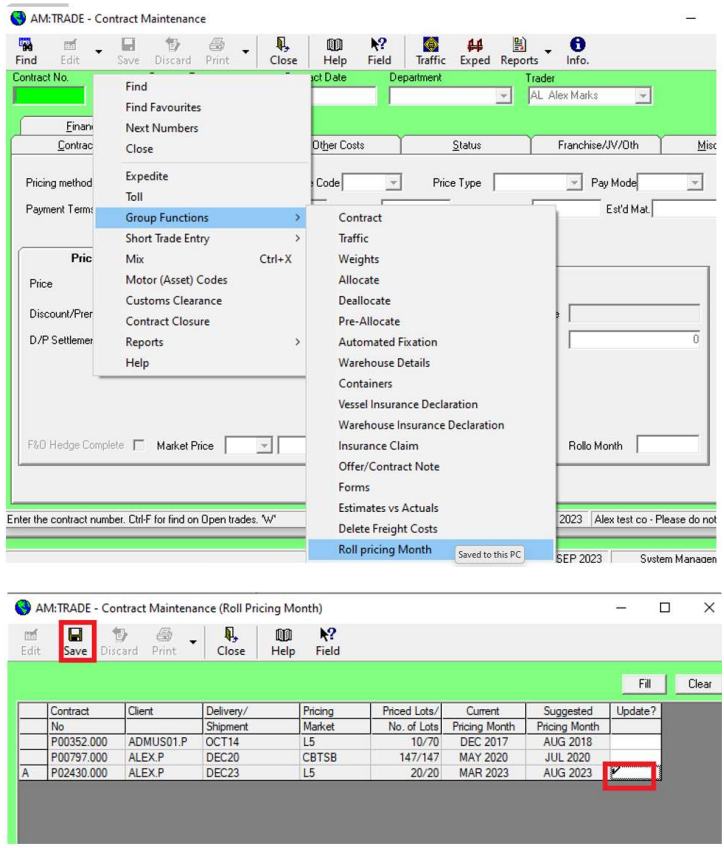

- Update pricing month using Trade/Group function

Identify the roll trades by their Trade i.e. flagged as 'Spread Roll'

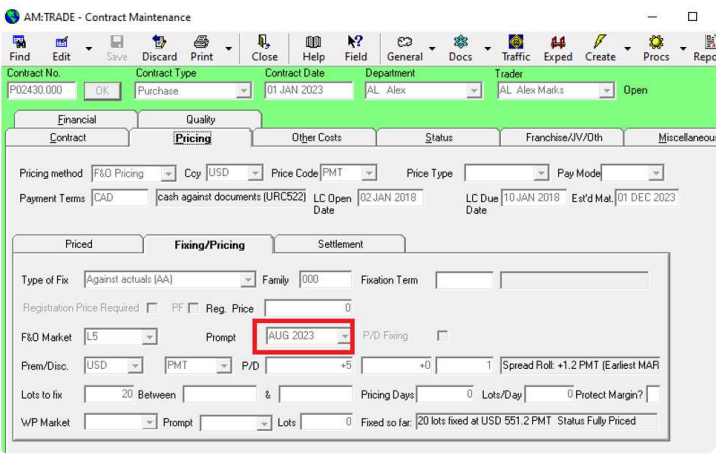

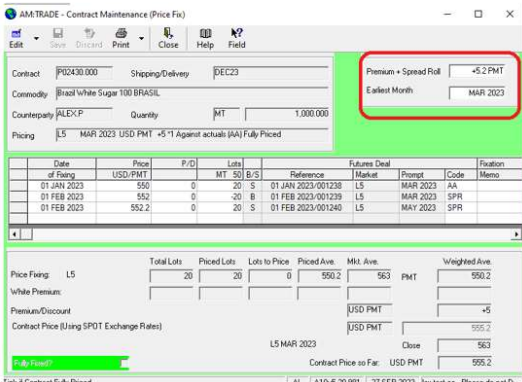

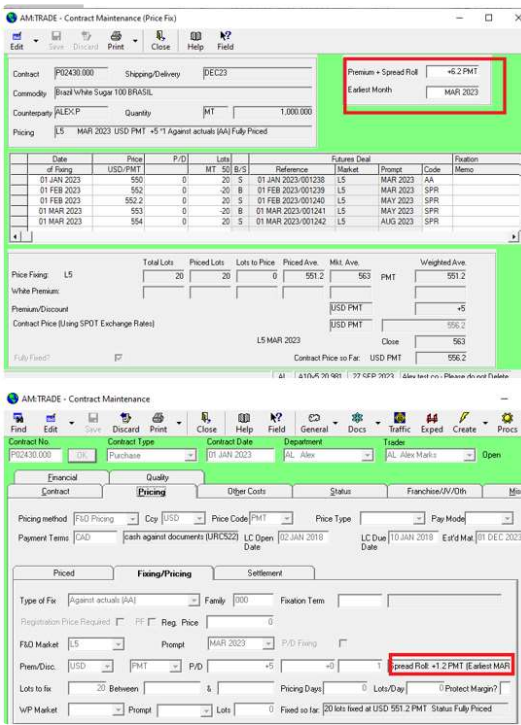

Save spread and earliest month as pricing is done

Initial pricing in March 2023

Roll to May 2023

Roll to August 2023

See the spread roll in GPREP/Valuation Report

Update pricing month

Updating the pricing month contract by contract is laborious. It is easier to use Trade/Group Functions...Roll pricing Month. This process analyses price fixations per contract where there is a roll (fixation with a 'spread roll' code). If the latest fixation month is different to the pricing month it suggests the Fix Family as a candidate to have their pricing month updated. All candidates are presented on a grid allowing the trader the option to update the pricing month to the roll month