Out Turn Weight (Cocoa)

Outturn weights are used primarily by Cocoa operations, in order to produce Invoices.

In TRADE Traffic, the user enters out-turn records where they maintain the number of bags matching a number of pre-defined categories (“Sound & Full”, “Torn/Slack” and so on). Multiple outturn records can be maintained. They can only be created on purchases, but are then picked up automatically by any allocated Sales.

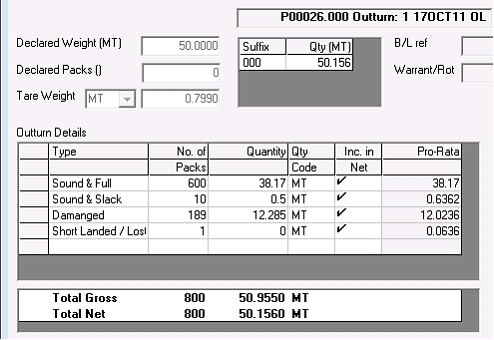

Invoicing can invoice according to the outturn weights, and will automatically invoice all splits that the weights apply to. It is normal to do this on finalisation. The Pro rata weight is calculated as row bags / Sound & Full bags x Sound & Full Weight.

TRAFREP has an Outturns report.

Configuration

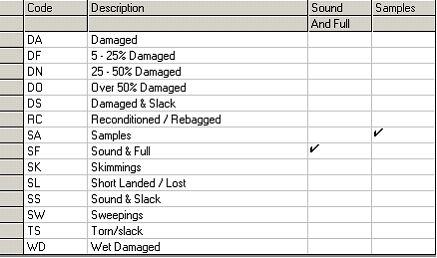

Outturn Weight Types are maintained in PHYSCODES:

Sound and Full and Samples are important because they contribute to the calculation of the Pro Rata weight. (Samples are included in pro rata weight even if not included in Net.)

Maintenance

Outturn weights are maintained via the TRADE Traffic screen. Multiple outturn weights can be maintained against a contract, and multiple contract splits can share the same outturn weights record.

When creating a new record the user is asked if they want to adjust contract weight in accordance with the outturn; i.e. not mandatory.

Invoicing

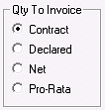

The following prompts are visible on the front screens of PINV and SINV:

They allow for the invoicing of out-turn weights, and work as follows:

· Contract: Invoices contract weight without reference to out-turn weights.

· Declared: This will invoice the declared out-turn weights. The declared weight is the weight entered as “Declared Weight” on the out-turn weights screen

· Net: This is the total weight that is ticked as “Inc. In Net” on the Out-turn weights screen.

· Pro-Rata: This is the total pro-rata weight on the Out-turn Weights screen. Pro-rata weight is calculated as row bags / Sound & Full bags x Sound & Full Weight. When we invoice this, the tare is take off.

For example with earlier out-turn data we get the following quantities to invoice:

· Contract Weights: 50.156 (i.e. phys01_conquan)

· Declared Weight: 50

· Net: 50.156

· Pro-Rata: 50.0944 (38.17 + 0.6362 + 12.0236 + 0.0636 – 0.7990)

Below are some worked examples as to how Out Turn weights can be applied

A. Example of a Final Invoice when the upper tolerance limit has been exceeded

Contract: 100 tonnes @ £1,900 per tonne, 1.5% tolerance

Declared: 1,540 bags weighing 100.100 tonnes

Provisional invoice weight (100.100 x 99%) 99.099 tonnes

Outturn:

| Bags | Weight | |

| 1.446 Sound & full | 97.542 | kg gross |

| 42 Torn & slack | 2.078 | kg gross |

| 12 Damaged & full | 752 | kg gross |

| 25 Damaged, torn & slack | 1.052 | kg gross |

| Samples | 8 | |

| 1.525 | 101.432 | kg gross |

| Tare 10 bags = 9.8kg | 1.495 | kg |

| | Total net weight 99.937 | Kg |

Note: there are 15 bags short-landed

Calculation: Average gross weight of one sound and full bag is

97.542/1.446= 67.4564 kg

Therefore gross weight of whole parcel if all bags had arrived sound 7 full

67.4564 x 1.540 + 103.883 kg

Add the sample 8 kg

| Deduct total tare of bags | 1.509 kg |

Net weight of arrived cocoa is: 102.382 kg

Tolerance of 1.5% on parcel sold exceeded

(100 + 1.5 + 101.5 tonnes) by 102.382 – 100

= 2.382 kg net

Assume: Buyer agrees to take cocoa, and according to Rule 14.3.4 then if:

(a) Parties agree market price (£1.870) on last day of weighing which is therefore lower than the contract price.

Calculation: 100.000 tonnes @ £1.900 per tonne £190,000.00

2.382 tonnes @ 1.870 tonne £4.454.34

£194.454.34

Less provisional invoice of £188,289.00

£6,165.34 Due to Seller

or:

(b) Parties agree market price (£1,935) on last day of weight which is therefore higher than the contract price

Calculation: 1000.00 tonnes @ £1.900 per tonne £190,000.00

2.382 tonnes @ £1.935 per tonne £4,609.17

£194,609.17

Less provisional invoice of £188,288.00

B. Example of a final Invoice when lower tolerance limit has been exceeded

| Contract: | 100 tonnes @ | £1,900 per tonne, 1.5% tolerance |

| Declared: | 1,540 bags weighed | 100.100 tonnes |

| Provisional invoice weight | (100.100 x 99%) | 99.099 tonne |

| | | |

| Outturn: | Bags | Weight |

| | 1,446 Sound & full | 93,212 kg gross |

| | 42 Torn & slack | 2,078 kg gross |

| | 12 Damaged & full | 752 kg gross |

| | Samples | 8 |

| | 1,525 | 97,102 kg gross |

| | Tare 10 bags = 9.8 kg | 1,495 kg |

| | Total net weight | 95,607 kg |

| | | |

Note: there are 15 bags short-landed

Calculation: Average gross weight of one sound and full bag is

93,212/1.446 = 64.4620 kg

Therefore gross weight of whole parcel if all bags had arrived sound & full

64.4620 x 1.540 = 99,271 kg gross

Add the samples 8 kg

Deduct total tare of bags 1,509 kg

Net weight of arrived cocoa is: 97, 770kg

Tolerance of 1.5% on parcel sold exceeded

(100-1.5 = 98.5 tonnes) by 100.000 – 97.9770

=2,230 kg net

Assume:

Parties agree, according to Rule 14.3.4 that market price on last day of weight is £1,935 and therefore higher than the contact price by £35.

Calculation:

97.770 tonnes @ £1,900 per tonne £185,763.91

Less 2.230 tonnes @ £35 per tonne £78.05

£185,685.86

Less provisional invoice of £ 188,289.00