REPOs

This document describes an ITAS procedure to administrate a Repo, alternatively known as ‘Commodity Inventory Purchase Obligation’ (CIPO). The guide centres on the Trade Physicals element and does not include any F&O transactions. The TRADE Purchase enables marking of Goods as ‘on Repo’ and the ‘loan bank/broker’. CASH is used for the receipt of loan and repayment i.e. standard accounting. The TRADE /Costs is used for the interest payment/cost attributable to that TRADE.

There is an alternative subsystem (S01 configuration ctrl40_physloan) that operates from TRS/Loans that enables individual Loans to be assigned to their REPO/CIPO/Trust Receipt.

Initial Setup

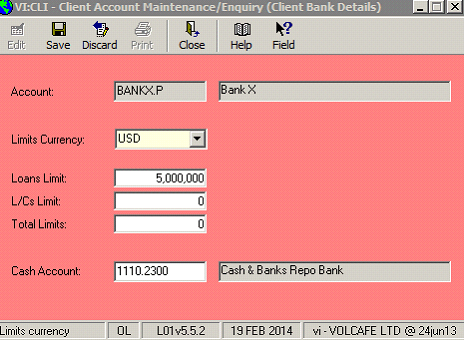

ITAS uses the “trust bank solution” for handling Repos. In order for the contract to be linked to a bank account, need to set up the bank as a client in ITAS. The guide below refers to banks only although occasionally, repos can also be transacted with a broker. Banks need to be ‘ticked’ in CLI as being designated bank accounts. Additionally, the client account should be linked to a nominal ledger bank account in CLI -> View Bank Trade Limits, as this will allow for accurate reporting in menu option BANKRVU.

A PHYSCODES/‘Goods Status’ code needs to be setup to represent repos. The code, suitably flagged will block ITAS procedures such as Allocation to Sale and application in Manufacture. This is necessary, whilst the goods are ‘in trust’.

Step 1: A purchase contract is created in ITAS.

A TRADE purchase from its’ supplier is created. This is the contract that will subsequently be sold to the bank as a repo (in full or part).

Step 2: Warrants attached to the purchase.

This step is optional as the repo process does not depend on there being warrants attached. Warrants can be added to contracts either manually or by the TRADE/Traffic import process. These are detailed fully in the warrants documentation.

Step 3: The contract is sold to the bank.

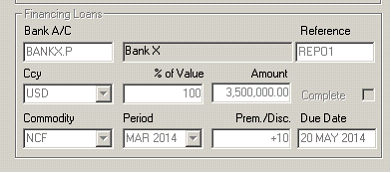

The purchase TRADE needs to remain in the company’s position but marked as ‘On Repo’. This requires completion of the “Financing Loans” section in TRADE (Financing tab):

Fields are as follows:

1. Bank A/C: The bank to which the contract has been sold. Must be a valid ITAS client set up as a bank account (see note above).

2. Reference: Free-format reference

3. Ccy: Currency of the loan

4. % of Value: Percentage of the contract value that is loaned. It will default to 100%.

5. Amount: Value of the loan. It will default according to the percentage, but any value can be entered.

6. Complete: This is to be ticked when the repo is bought back i.e. Loan repaid.

7. Commodity/Period/Prem./Disc: These fields allow the loan to be marked-to-market. BANKRVU will determine the market value from these and display as the collateral value; if left blank BANKRVU simply uses the value of the loan as the collateral.

8. Due Date: Date that the loan is to be redeemed.

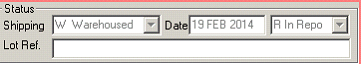

Additionally the user will mark the TRADE/Traffic with a Goods Status code to represent repos:

At the same time, cash can be received from the bank. Use CASH/Simple receipt, posting between the nominal ledger bank account and a balance sheet loan account. The cash receipt will be picked up in BANKRVU, if CLI bank linked to its’ GL (NOM) account.

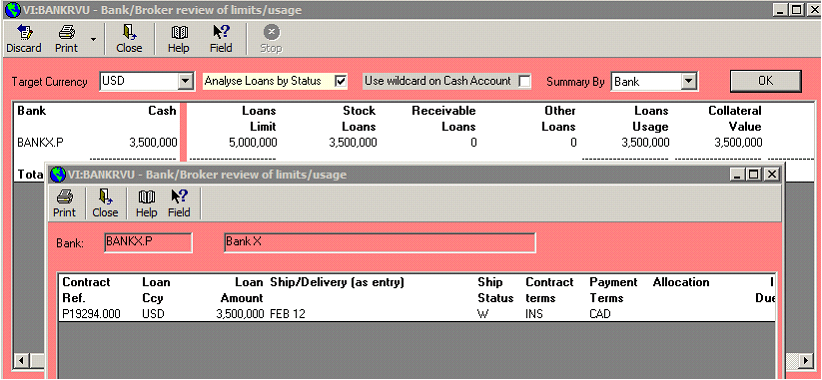

When these details are completed, loans can be monitored in BANKRVU. Details of BANKRVU can be found in the help system. The following screenshot shows how the details entered above would be displayed in BANKRVU:

A loan is not considered “used” until the TRADE has been Purchase invoiced and cash matched, and will be reported in the Nominated Loans column. Once it is invoiced, it will then be categorised as “used” and be reported in the usage columns. In this case it is marked as a “Stock Loan” since the goods are setup with Shipping Status = warehoused.

Step 4: The repo expires

There are several options here depending up what action is intended for the repo:

· The contract can be repurchased in full

· The contract can be repurchased in part

· The repo can be renewed for another period of time.

Step 4a: The contract is purchased from the bank in full

In this scenario the full contract quantity is repurchased from the bank. In this situation, the TRADE needs to be marked as Complete in TRADE/Finance and the Repo claim flag removed in the TRADE/Traffic screen. The contract will then excluded from BANKRVU and will be available for standard processes in ITAS.

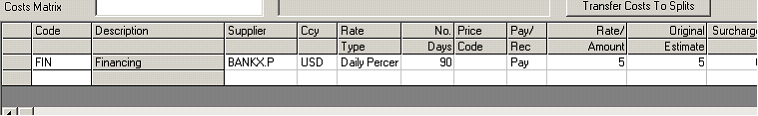

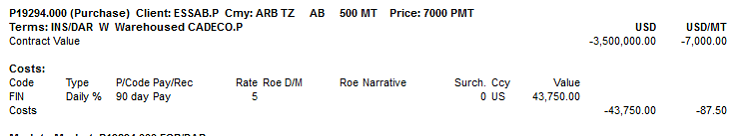

The loan can be repaid using a cash payment. Any interest on the loan can be created as a cost in TRADE thus it will affect the contract P&L and can be actualised (invoiced). The company can be set up to operate “Daily Rate” cost types based on entered number of days to automatically calculate interest. In the example below, we have 5% based on 90 days:

Step 4b: The contract is purchased from the bank in part

In this scenario, only some of the quantity is repurchased from the bank. This can be achieved by splitting the contract. If warrants are assigned to the contract, these will need to be picked as part of the splitting process.

Once the TRADE is split, both splits have independent financing details in TRADE. So if, for example, 100 MT of a 500 MT contract is purchased, a 100 MT split would be created in TRADE, and this would need to be ticked as Complete, leaving the remaining 400 MT still active as a loan. The Goods Status flag can also be cleared on the relevant split. BANKRVU would therefore show a decreased loan value.

Repayment of the loan and interest payment would be similar to step 4a.

Step 4c: The repo is renewed for another period of time

In this scenario, all that would be required would be to update the details in the TRADE Financing Loans section – for example, entering a new due date and updating the values.

Interest payment would be similar to step 4a.