BRCODES - Support for Brazil Domestic

In conjunction with core ITAS support codes e.g. PHYSCODES, CLICODES , expliict Nota Fiscal codes are needed to support the Brazil domestic processes

CFOP Codes

The CFOP code represents the transaction type and is mandatory in the Nota Fiscal. They are controlled by the Brazilian government.

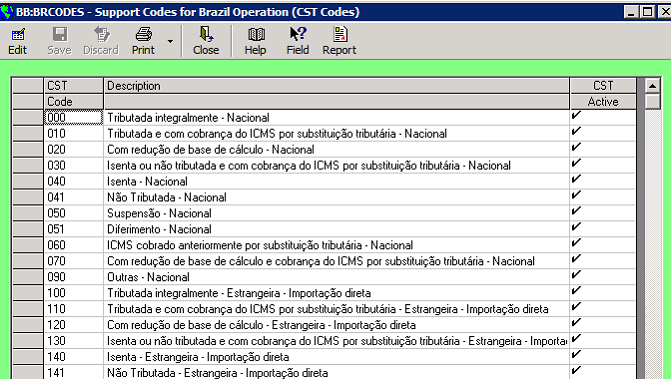

CST Codes

The CST Code represents the tax authority classification for the transaction and goods being transacted. It’s a combination of 2 tables:

a) origin of goods (1st digit) and

b) taxations for ICMS. (2nd and 3rd digit)

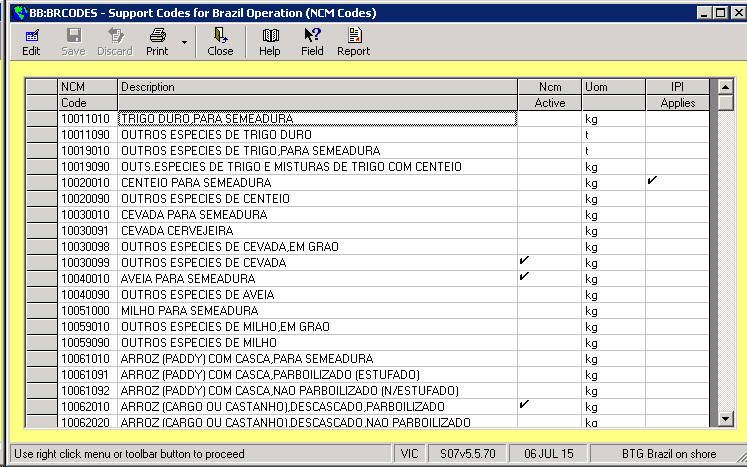

NCM Codes

The NCM code represents the product being invoiced and is mandatory in the Nota Fiscal. There are more than 9,000 NCM codes which can be imported into ITAS (by Hivedome). The system administration manager ticks ‘NCM Active’ for those items to be available to the users. These codes are controlled by the Brazilian government.

The Ncm code is linked to the Itas commodity code in PHYSCODES/Commodity codes and the Uom is linked to the Itas Weight code in Physcodes/Weight Codes. The content of the import is a total list from the Brazil Government Agency and there will be UOM codes that are not relevant to the ITAS entity and will not need to be marked as active; they can be deleted.

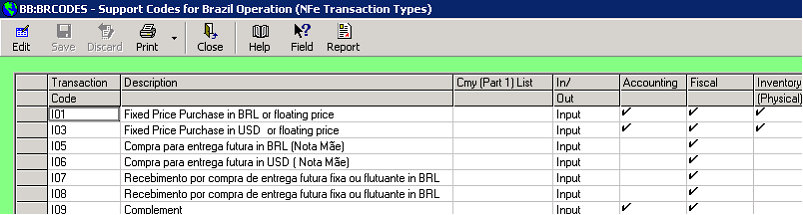

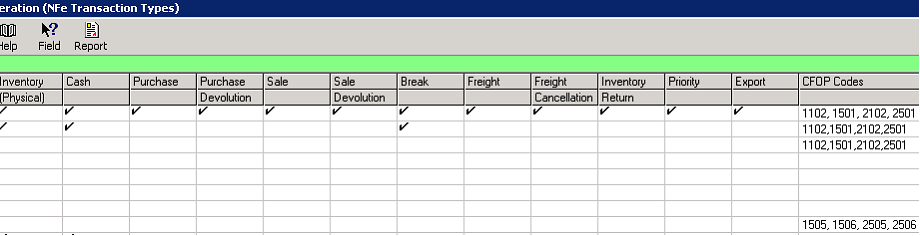

NFe Transaction Types

The Nota Fiscal Transaction types are not sent to Sefaz but are used to inform the system what impact the Note Fiscal has for inventory, tax etc. It is mandatory on the Note Fiscal.

The Cmy (Part 1) list and CFOP codes will restrict the number of transaction types which may be selected for an NFe. A blank Cmy list means all commodities.

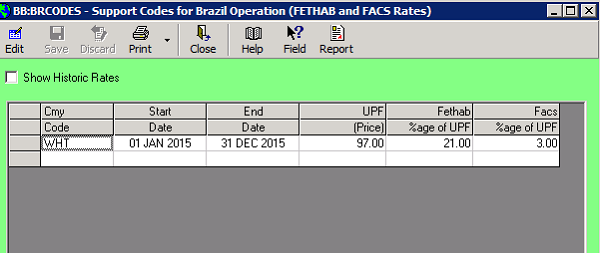

FETHAB and FACS Rates

FETHAB and FACS are withholding taxes on payments to individual producers as opposed to companies (CLI Flag chr20_canbeaprivateperson) and are based in specific states (e.g. Mato Grosso).

The tax is charged on the Nota Fiscal Quantity. The rate is per principal commodity code and changes quite frequently.

UPF is the current price of the product in the UOM from the NCM code list. Then the %age of UPF is maintained for FETHAB and FACS.

For example:

UPF of 99.23, FETHAB % of 9.6, NFe quantity of 50 t; FETHAB value = 50 X 99.23 X 9.6 / 100 = 476.30 BRL.

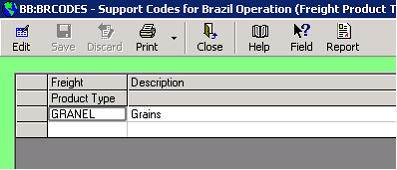

Freight Product Types

The Freight product types are an item to be included in the Freight section of the Nota Fiscal

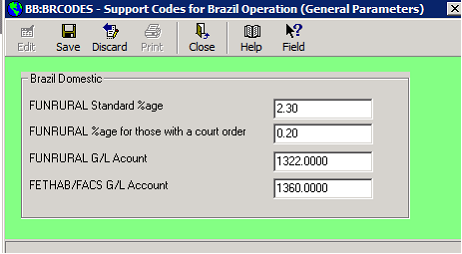

General Parameters

General Parameters are where specific items may be maintained

FUNRURAL is a federal withholding tax on the payments to individual producers as opposed to companies (CLI FLAG chr20_canbeaprivateperson). The tax is actually composed of 2 subsets INSS and SENAR. Those without a court order pay the full amount (i.e. 2.3% in May 2015), those with a court order just pay SENAR (i.e. 0.2% in May 2015)

The 2 G/L accounts are for the withholding tax when applied in invoicing.

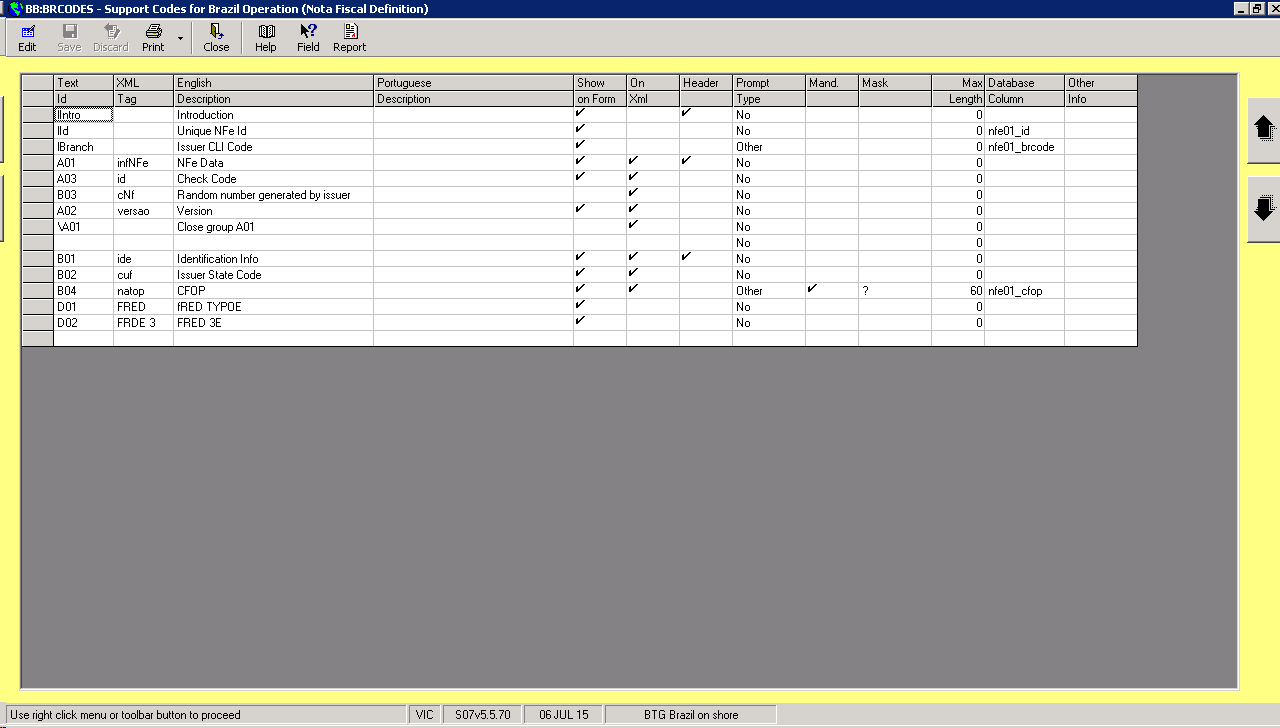

Nota Fiscal Definition

The Nota Foscal typically has 200 cells to be populated, this process enables user definition of those cells with features for resequence. The PROMAN (Nota Fiscal) system configuration enables the setup to use hard coded form or User definition