Cotton Position Reporting

GENENQ – Tradenet, Position Recap, Daily Position, Spread

INVENTORY – Inventory Recap, Position Report

Considerations

· Period for Position

· Criteria for Grouping

· Handling of Equity

· Handling of Certificated Cotton

· Futures to include

· Level of Reporting – Summary/Detailed

GENENQ

Tradenet

This report includes Physicals and Futures and is used to show Monthly Exposure. It is more applicable to Lot based operations where Contract splits match Lots as opposed to Bale based operations where inventory is applied to Contract splits/headers in parts so the Open quantity on the Contract is reduced over time

Physicals

Priced Physicals are presented by Position Period (apply Position Code to Shipment Period) or Valuation Period as requested.

Unpriced Physicals are presented by Position Period or Prompt Month as requested.

Partially Priced Physicals are split into Priced and Unpriced.

Sales are reported as negative quantity.

Pricing to Come is represented by Unpriced Physicals.

Physicals are grouped by the Commodity Group Code.

Futures

Futures flagged as Hedging Futures are included. These are recognised from the account on the trade (must be flagged as a House Account) and the code on the trade (must be set up as a hedge/fix).

Futures are reported under their Prompt Month.

Futures are grouped by the TCCM group code.

The inclusion of Settled Futures is optional.

‘Other Futures’ (i.e. not Hedges for House Accounts) are included but do not influence the Net Position.

Delta Options

Options with the Delta applied may be included (optional) and affect the Net Position.

In the Money Options

These Options for House Accounts may be included.

Net Position

The Net Position is Priced Physicals + Unpriced Physicals + Hedge Futures + Pricing to Come + Delta Options.

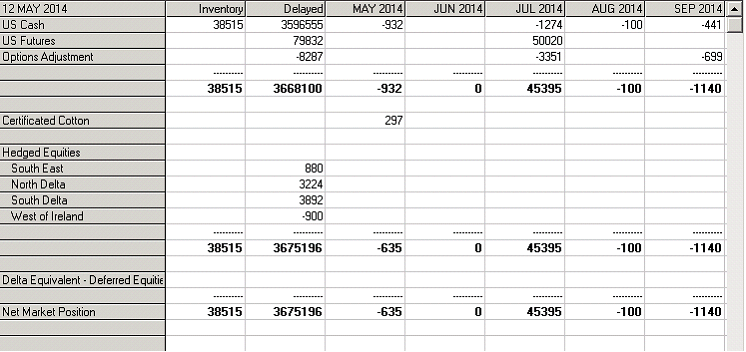

Position Recap

This report includes Inventory, Physicals and Futures and is used to show Monthly Exposure.

Inventory

Includes Unapplied (no Sale) or Consignment Inventory which is neither Certificated nor Equity. The Inventory section is viewed as ‘Spot’

US Cash Physicals

Purchases and Sales are included net of inventory. Sales are reported as negative quantities. Physicals excludes Equity and Certificated Contracts. The Position Type (Start, End, Pro-Rata) is applied to the Shipment Period in order to present the Physicals.

US Futures

Futures with a code which is flagged as External (see TERMCODES). Futures are positioned under their Prompt Month.

Options Adjustment

Options with Delta applied. Options are positioned under their Prompt Month.

Certificated Cotton

Certficated Cotton includes Cotton already flagged as Certificated (has Cert class) and Cotton for which Certification has been requested – indicated on the Group Sub-Type.

Certificated Cotton includes Certificated Physicals (driven by flag on Contract Terms) net of applied inventory (therefore Open)

Hedged Equities

Equity Contracts can be set up with the number of bales requiring Hedging. The figure is net of any Redeemed bales on the Contract. The Position Month is determined from the Contract Shipment and Position indicator. Hedged Equities are listed by Market Growth.

Net Market Position

The Net Market Position is the sum of Inventory, US Cash Physicals, US Futures, Options Adjustment, Cert Cotton and Hedged Equities.

Redeemed bales

The section for Redeemed bales (Equity that has been Redeemed) is segregated in Coop bales and owned bales.

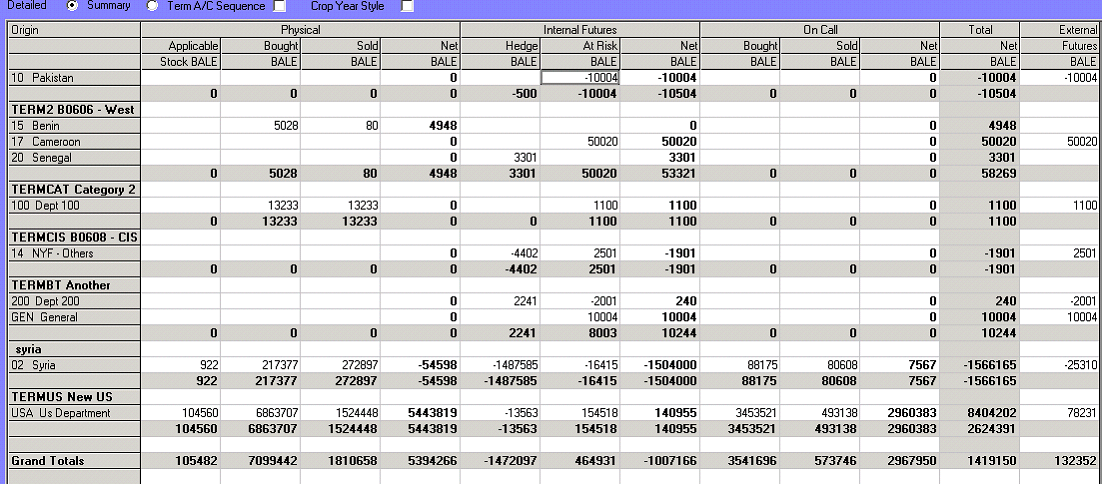

Daily Position

There are 3 styles for the Daily Position Report. These are Detailed, Summary and Crop Year Style.

Detailed

The report is separated into sections for Priced Physicals, Internal Futures, On-Call Physicals to provide a net figure. There is a breakdown by Growth/Department within SBOX (Category)

Physicals

Inventory which is not applied to a Sale or is on Consignment

Open Purchases which is Purchase Contract Quantity less Inventory against the Purchase

Open Sales which is Sale Contract Quantity less applied Inventory, not invoiced

Internal Futures

Hedges are Futures against a House Account where the Futures Code is flagged as ‘Internal’ in TERMCODES

Mirrors are Futures where the Futures Code is flagged as ‘Mirror’ in TERMCODES.

The ‘At Risk’ column displays the Exposure and includes Mirror trades and External trades - Futures Trades with a code flagged as ‘External’. The principle is that the ‘Internal’ Future is used to Hedge the Physical at Contract level and the ‘Mirror’ is the opposite entry created at the same time. The real Hedges are created at summary level so by offsetting Mirrors and Externals the Risk is ascertained (they should net to zero if every Physical is hedged)

The Net Internal Futures Position is the sum of the Hedge and At Risk values

On-Call

The On Call Position shows bales Unpriced. The Net On Call position comes from the On Call Purchases less the On Call Sales.

Total Net

Total Physicals + Internal Futures - On Call Position

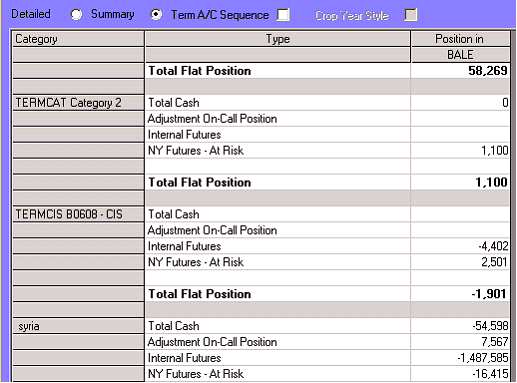

Summary

This report includes the same details as the Detailed report but produces a different Presentation.

Total Cash

Total Physicals and Inventory

Adjustment On-Call Position

On Call Purchases and Sales

Internal Futures

Hedge Futures

NY Futures at Risk

Mirror and External Futures

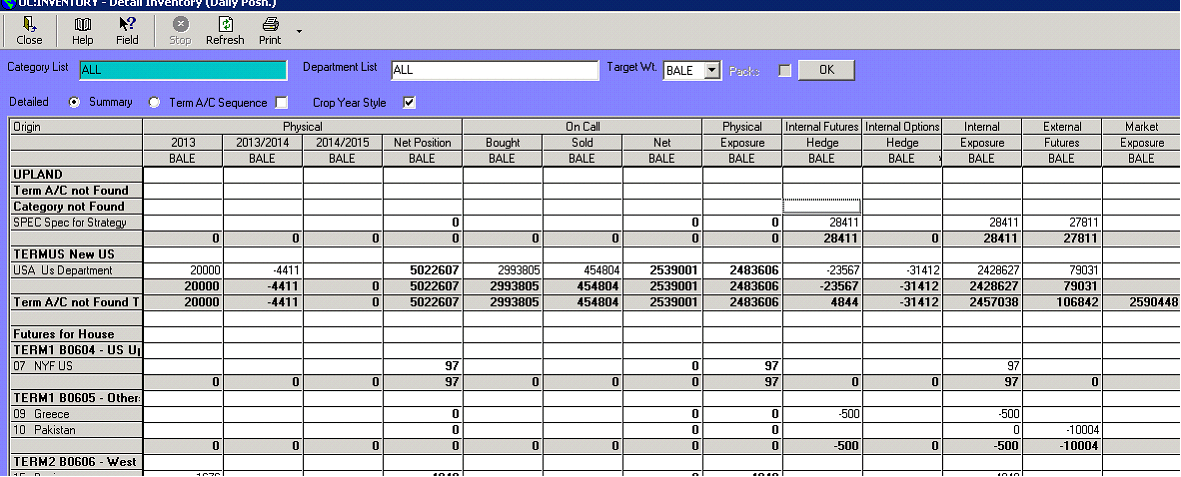

Crop Year Style

This report includes the same details as the Detailed and Summary reports plus Internal Option Hedges (Option Trades with a code flagged as ‘Internal’) , the delta equivalent of the Internal Options Hedges, the delta equivalent of Mirror Option Hedges (Option Trades with a code flagged as ‘Mirror’), the delta equivalent of External Options (Option Trades with a code flagged as ‘External’). The Physicals are displayed by Crop Year.

Market Exposure

This is Physical Exposure + External Futures.

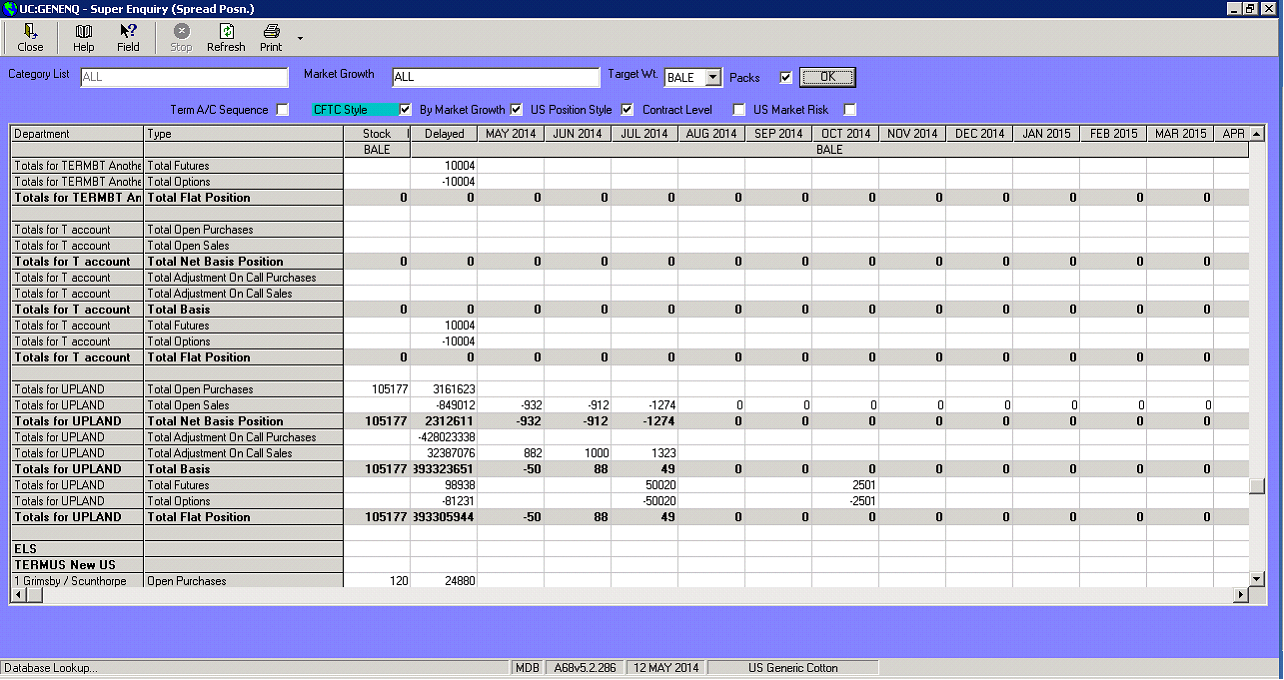

Spread

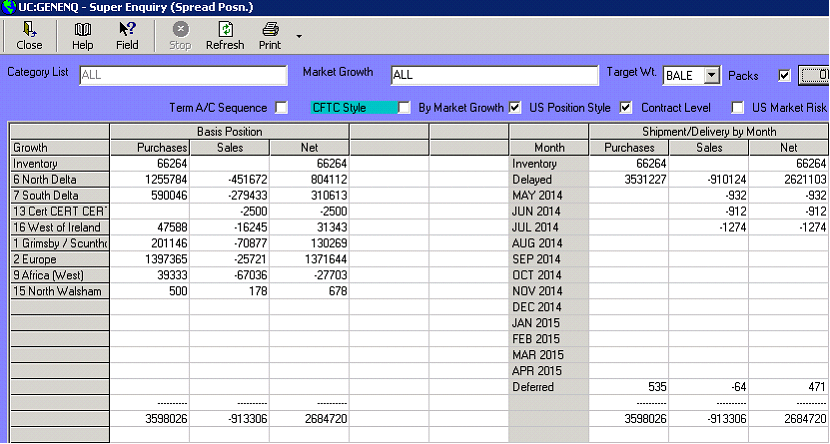

The Spread Position process produces reports by Shipment Month and Department/Market Growth with different presentations.

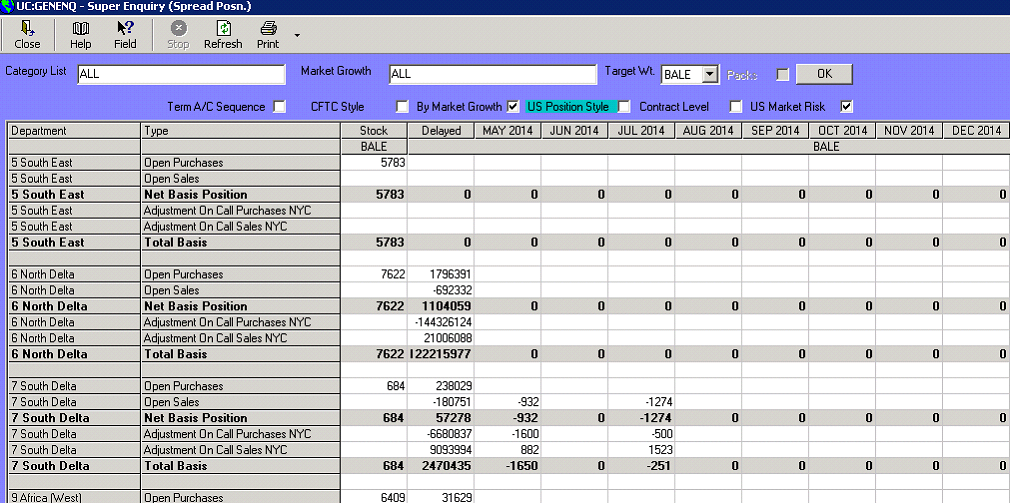

US Position

There are several sections to this report.

Inventory and Physicals are displayed by Market Growth and Shipment Period with Position Type applied.

Basis Position

Inventory not applied to a Sale, not Equity

Deduct Equity that has been applied from the Inventory position

Open Purchases which are Cash Purchases net of Inventory

Open Sales which are Sales net of Inventory. If the Inventory is assigned to the header of a multi period contract the assigned inventory is apportioned to the period tranches on a FIFO basis.

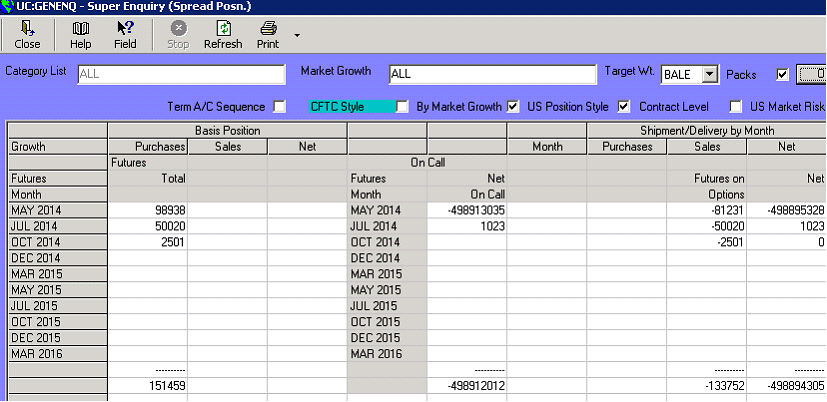

Futures and On-Call Physicals are displayed by Futures Month.

On-Call Position comes from unpriced bales on any On-Call Contract. The quantity is displayed according to the Pricing Month on the Contract.

Equity is excluded.

The Futures are External (any Futures with a code that is not flagged as ‘Internal’ or ‘Mirror’ in TERMCODES) with a strategy of 1,5, or 6

Futures on Options are External Futures Trades in Strategy 5 or 6 which are ‘backed out’ (signs reversed

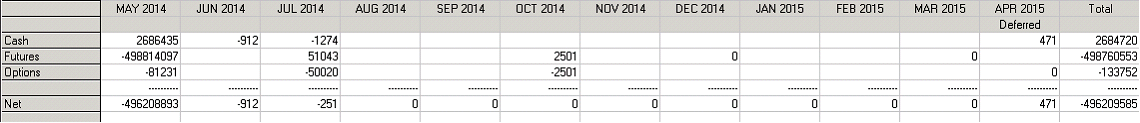

Cash, Futures and Options are displayed by prompt Month.

Cash matches the Inventory and Physicals in the Basis Position.

Futures come from External Futures plus On-Call Position.

Options come from External Futures which are Strategy 5 or 6.

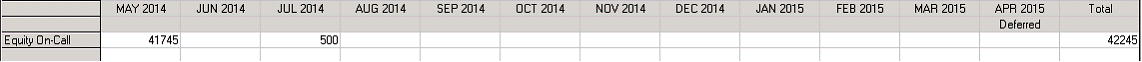

On-Call Equity is displayed by Pricing Month.

The figures come from Equity Contracts which are marked as being On-Call.

CFTC Style

Sales Invoiced Inventory is excluded but applied and uninvoiced Inventory is included

Other details are the same as for the US Position Report.

Display is by Department within Upland/ELS Cotton categorisation

Market Risk

Report is by Department within Term Account within Upland/ELS categorisation

Inventory

Inventory that is not applied, not Equity

Deduct Equity that has been applied to a Sale

Physicals

Purchases which are not Equity, not Coop net of Inventory

Sales net of applied Inventory

On-Call Purchases to show unpriced bales by Pricing Month with a reverse sign (negative)

On-Call Sales to show unpriced bales by Pricing Month with a reverse sign (positive)

External Futures

Futures in Strategy 1,5 or 6 which are neither Internal nor Mirror Trades according to the TERMCODES flag.

Options

Futures Trades in Strategy 5 or 6 with a reverse sign.

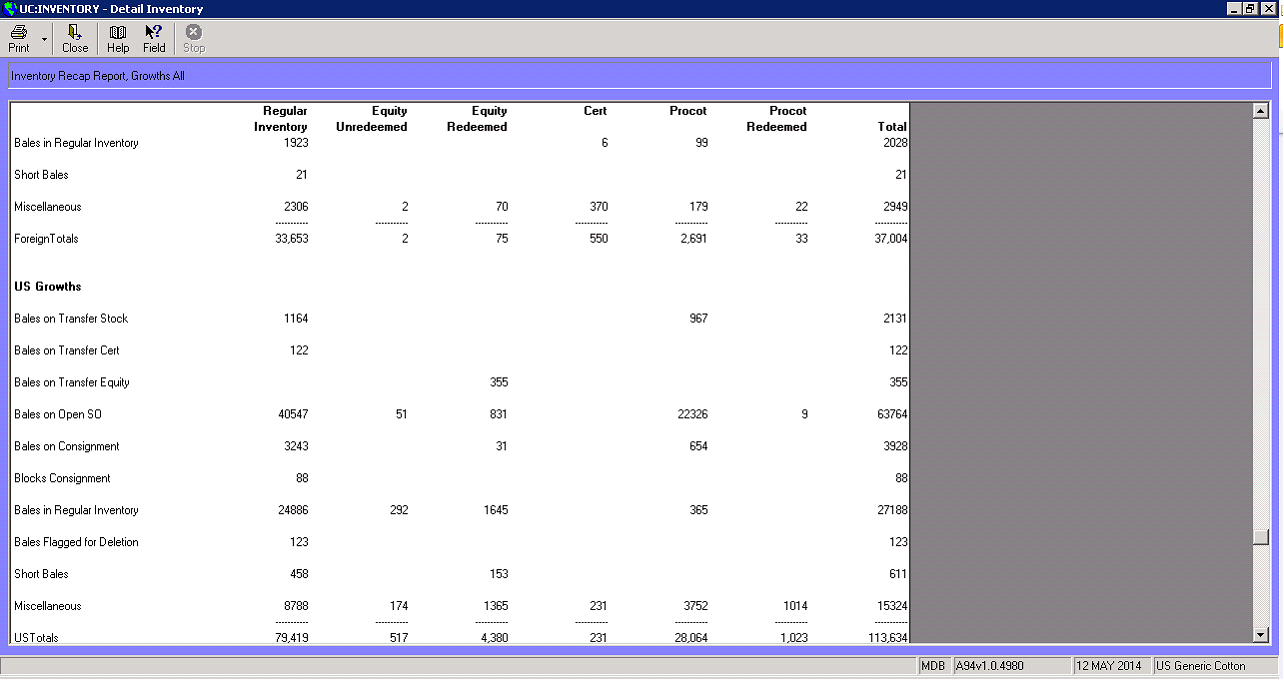

INVENTORY

INVENTORY RECAP

This report analyses the Inventory Position and categorises the Inventory according to:-

Owned or Coop (Procot) bales

Regular Cash Inventory (not Cert, not Equity)

Unredeemed Equity (bales still in Warehouse as Equity)

Equity Redeemed (bales selected for Redemption)

Certificated (Cert Quality, deliverable to Market)

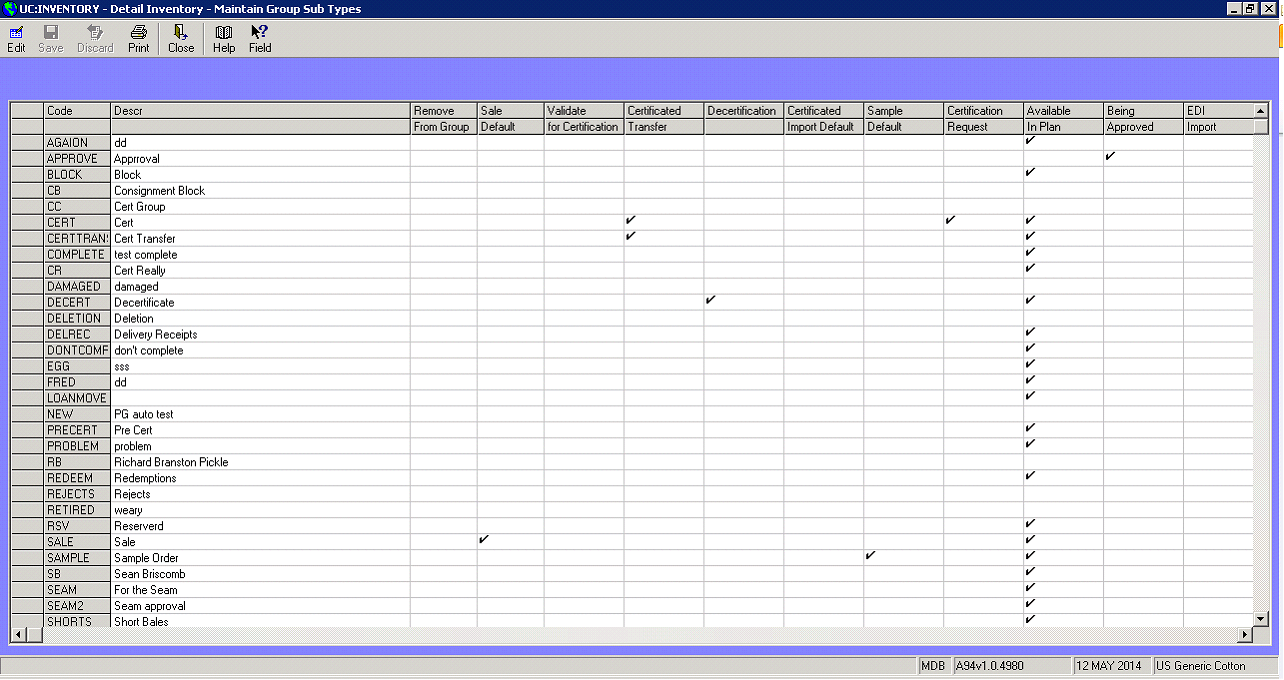

The bales are further segregated according to the subtype of the Groups should the bales be grouped. If ungrouped the bales will appear as ‘Bales in Regular Inventory’. If applied to a Consignment Sale the bales will appear as ‘Bales on Consignment’. If applied to a Sale the bales will appear as ‘Bales on Open SO’

| Bales on Approval | Bales on an approval group – Group subtype is ticked as being approved |

| Bales on Transfer Stock | Bales on an transfer stock group – Group subtype is ticked as being transfer stock |

| Bales on Transfer Cert | Bale on a cert transfer group – Group subtype is ticked as Certificated Transfer. |

| Bales on Transfer Block | Bales on an transfer stock group – Group subtype is ticked as being transfer block |

| Bales on Transfer Equity | Equity bales on an transfer stock group – Group subtype is ticked as being transfer stock |

| Problem Bales | Equity bales on an problem bale group – Group subtype is ticked as Problem |

| Bales Retired | Equity bales on an retired group – Group subtype is ticked as retired |

| Rejected Bales | Equity bales on an rejected group – Group subtype is ticked as rejected |

| Bales on open SO | Applied bales |

| Bales on consignment SO | Bales applied to a consignment sale |

| Bales on transfer Equity SO | Equity Bales on a transfer stock group applied to a sale. Not arrived at destination |

| Bales in Regular Inventory | Open Bales – not grouped |

| Bales in Regular Inventory (TE) | Equity Bales on a transfer stock group applied to a sale. Arrived at destination |

| Bales on billback Reject & weights | Bales which have been reinvoiced to a domestic mill |

| Bales on billback quality | Bales which have been reinvoiced to a domestic mill |

| Bales on damage claims | Equity bales on an damaged group – Group subtype is ticked as damaged |

| Bales on writeoff status | Bales assigned to a write off purchase split. |

| Bales flagged for deletion | Equity bales on an detetion group – Group subtype is ticked as deletion |

| Bales on Seam Approval | Equity bales on an seam approval group – Group subtype is ticked as seam approval |

The Subtype Maintenance Screen which drives the Inventory Recap Report is as follows:-

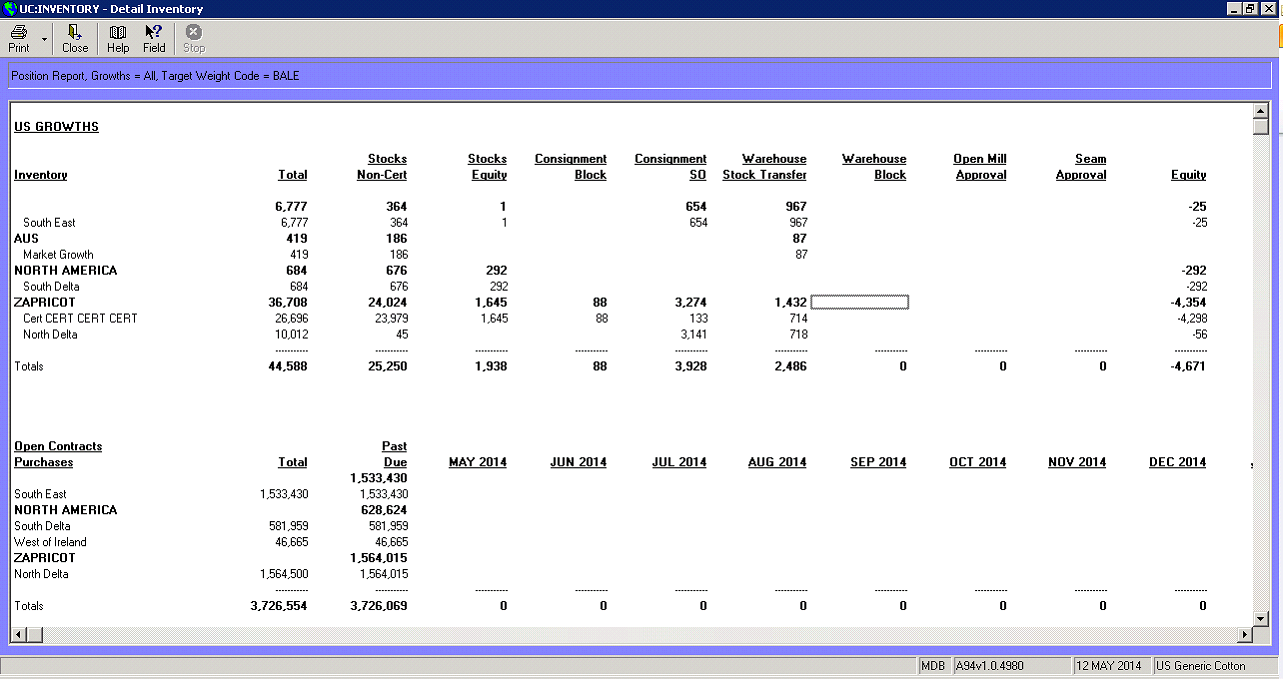

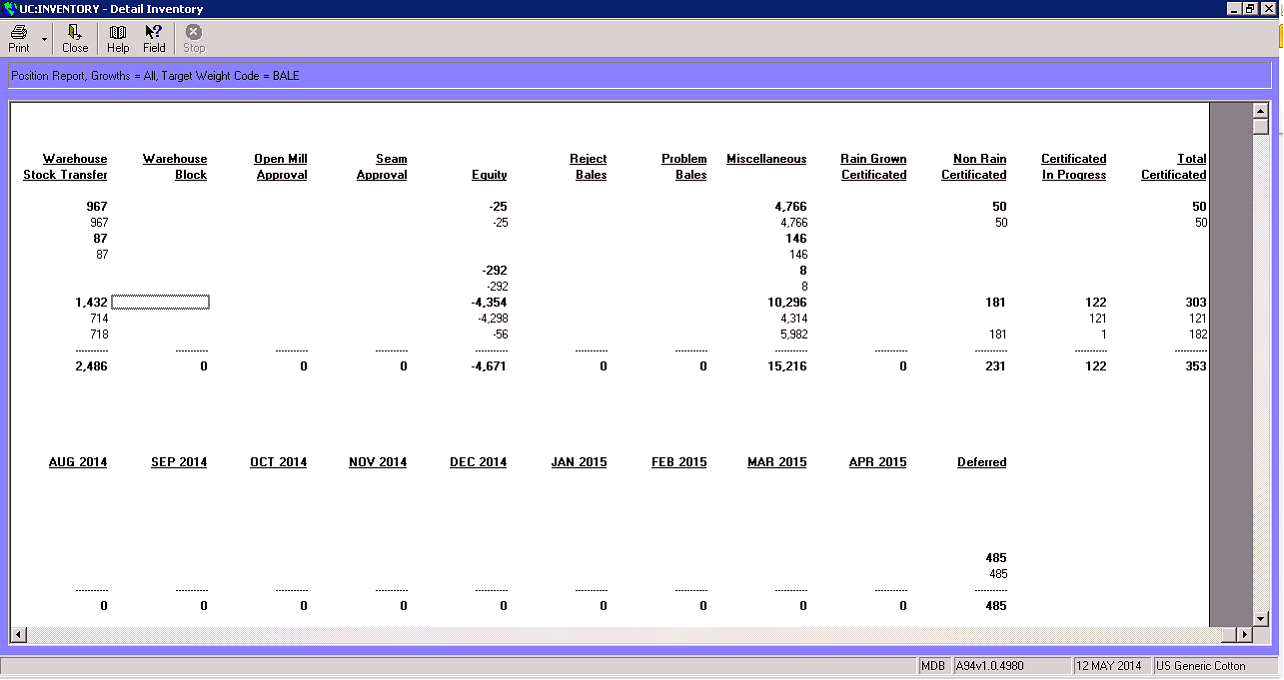

INVENTORY POSITION REPORT

This report combines the Inventory Position with similar categorisation as the Recap report with Open Purchases and Sales. The report is segregated into US and Foreign (non-US) growths.

| Inventory | All inventory categories are broken out by Growth |

| Stocks- non cert | Inventory not grouped , not cert |

| Stocks - equity | Equity bales not grouped |

| Consignment SO | Bales assigned to a consignment sale |

| Whse Transfer Stock | Bales on a group with a transfer sub type |

| Whse Transfer block | Bales on a group with a transfer block sub type |

| Cert – In loan | Cert and Equity bales |

| Open Mill approval | Bales on an Approval Group |

| Seam Approvals | Bales on a Seam Approval Group |

| CCA Redeemed | Redeemed Bales with a CCA Growth |

| Equity | Equity Bales not grouped |

| Reject Bales | Bales on a Reject Group |

| Problem Bales | Bales on a Problem Group |

| Regular Inbound not updated | Applied to purchase contract but not invoiced |

| Equity being redeemed | Equity bales where redeem status not blank. |

| TOTAL INVENTORY | |

| Open Contracts: | |

| Purchases by growth | Broken out by delivery month |

| Sales by growth | Broken out by shipment month |

| Net Position in total | |