Case Study: EDICOM Integrations

Overview

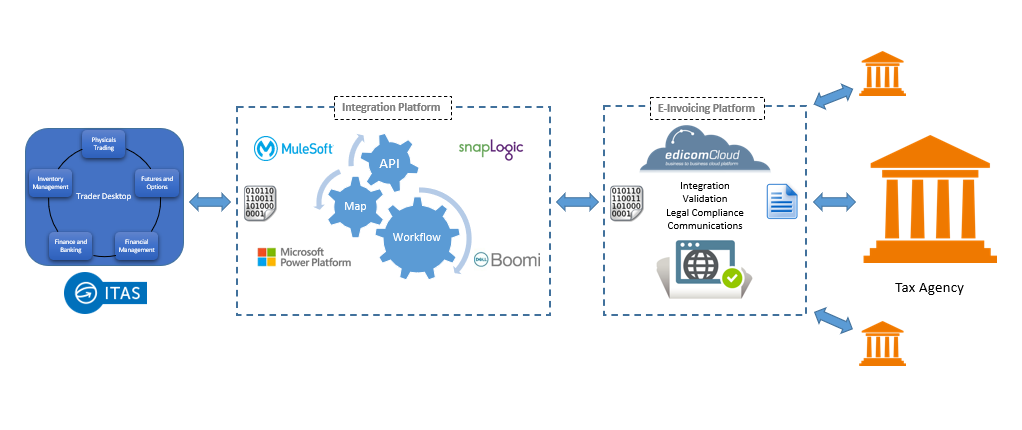

Each Government e-Invoice mandate will likely have it's own specific requirements regarding data. formatting, messaging, security and workflow. Traditional approaches involve tightly integrating ITAS processes to each mandate which as well as being costly to develop and support, is also vulnerable to subsequent change at the Tax Authority end. The solution is to break out the responsibilities to three areas:

- Data Repository

- Middleware

- Delivery Service

We have been working through our key stakeholders with EDICOM to achieve this solution.

For further details on EDICOM see EDICOM Global e-Invoicing Platform | Platform Architecture

To view the workflow for a typical e-Invoice solution see e-Invoicing ITAS EDICOM Workflow

Data Repository

In terms of ITAS, as well as providing the source of the data being reported, it also provides the means to capture it (invoice management) and publish notifications when an event is triggered (invoice created).

Middleware

Controls the workflow and effectively joins the source (ITAS) and target (Government). As the diagram shows above, the Integration Platform is used to manage the workflows, monitor its performance, handle connectivity and deal with any failures. It is responsible for extracting and presenting the data to the format required by the Delivery Service.

Delivery Service

The Delivery Service is fully responsible for the request once it accepts the data from the Middleware. It will maintain the interface requirements demanded by the Government mandate in question and handles all workflow/interaction between its own and the Governments platform. This includes guaranteeing delivery and generating a response for the consumer of its Services (the middleware process).